Terminology Guide - "S"

Scalp: A quick intraday trade.

Scanner: A tool used by traders to compile a list of stocks to potentially trade based off of predetermined criteria (filters).

Shakeout: A scenario in which investors are scared out of a stock before the stock makes the intended move.

Short Interest: The number of shares that are sold short that investors have not yet covered. This is usually expressed as a percentage of the float.

Short Squeeze: A scenario in which the price of a stock that has a high short interest makes a bullish move quickly, resulting in panic covering from short sellers. This results in a significant contribution to the momentum of the stock.

Simple Moving Average: A type of moving average that is calculated by averaging the closing prices of a certain number of data points. This is the most commonly used moving average as it provides equal weight to each data point.

Spike: A sudden increase in share price on high volume. The stock usually drops after this sudden move to the upside.

Spread: The difference between the bid and the ask. A larger spread usually indicates that the stock is more volatile and risky.

SSR: Short sale restriction.

Stairstepper: Price action in which the stock slowly upticks/downticks, taking typically more than a minute to make multiple upticks/downticks.

Stop Loss Order: An order type that allows investors to buy or sell a stock when it trades passed a certain price. This is a great order type to use in order to define your risk and stick to your game plan.

Support: A price level in which a stock has difficulty breaking below. Many investors like to enter long positions or exit short positions at support.

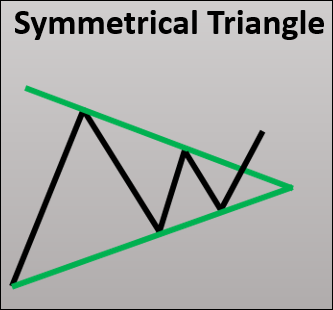

Symmetrical Triangle: A chart pattern in which two converging trend lines (one upper and one lower) provide an opportunity for the stock to make a decision to resume its trend or reverse it. A breakout through either of the two trend lines signals the upcoming trend.

[btnsx id="2796"]